From Kitchen to Entrepreneurship: Streamlining Annapurna Yojana

The Annapurna Scheme is a government project in India that seeks to promote women entrepreneurs in the food service sector by facilitating finance and encouraging female entrepreneurship. This blog discusses the scheme's qualifying criteria, participating banks and financial institutions, and the general registration process. The Annapurna Scheme intends to help women become financially independent and contribute to the country's economic prosperity.

The Annapurna Scheme is a government scheme developed by the Government of India's Ministry of Social Justice and Empowerment to provide loan facilities to satisfy the working capital needs of women entrepreneurs in the food service sector.

The scheme aims to empower women by providing them with financial support and promoting female entrepreneurship in the country. It targets women who own and operate small food catering businesses like tiffin services, food stalls, or canteens.

The scheme encourages and supports female entrepreneurs in starting their own food catering enterprises, hence encouraging female self-employment and entrepreneurship. The plan intends to help women to become financially self-sufficient and contribute to the country's economic progress by offering access to credit and financial support.

FINANCIAL SUPPORT:

Women entrepreneurs can apply for loans up to Rs. 50,000 under the Annapurna Scheme, with no collateral required. The loan term is 36 months, and the interest rate is set by the lending institution. The scheme aims to provide women entrepreneurs in the food service sector with easy access to loan facilities to meet their working capital needs. The loan amount should be used to meet the business's working capital needs.

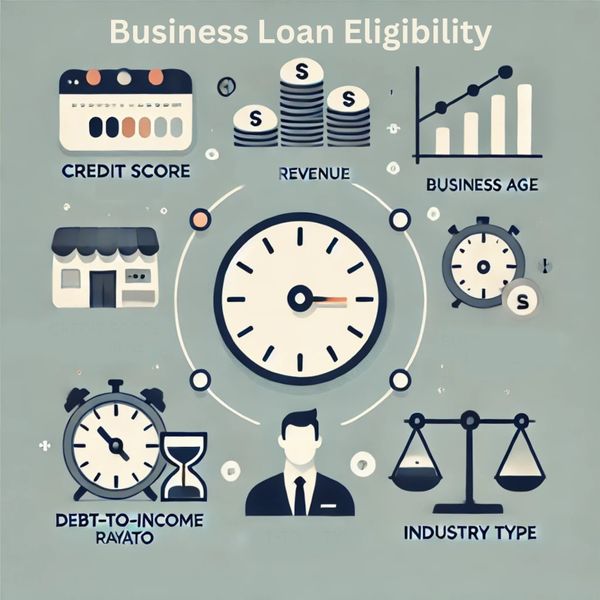

ELIGIBILITY CRITERIA:

- The plan is only offered to female food catering entrepreneurs.

- The applicant must be an Indian citizen over the age of 18.

- Prior experience in the food and catering business is required.

- The woman candidate should own and operate the firm, either independently or jointly.

- The company should run a small-scale food catering business, such as tiffin services, food booths, canteens, and so on.

- The company must have been in operation for at least one year.

- The candidate should not have failed on any bank or financial institution loans.

- The applicant must have a good credit rating.

- The loan amount should be used to meet the business's working capital needs.

Please keep in mind that these are basic qualifying requirements, and the particular requirements may differ based on the lending institution and the location of the firm. Before applying for loans, it is usually a good idea to verify with the respective bank or financial institution for precise qualifying conditions.

Documents required for Annapurna Yojana:

You must submit the following documents to apply for the Annapurna Yojana:

Age proof: You must provide proof of your age, such as a birth certificate or Aadhaar card.

Identity proof: You must provide proof of your identity, such as a PAN card or Aadhaar card.

Address proof: You must provide proof of your address, such as a utility bill or an Aadhaar card.

Bank account information: You must provide your bank account information, including the bank name, branch name, account number, and IFSC code.

Photograph: A passport-sized photograph of the candidate is required.

Participating Banks & Financial Institutions:

The Annapurna Scheme is implemented across the country by various banks and financial organizations. Among the institutions taking part are:

- State Bank of India

- Punjab National Bank

- Bank of Baroda

- Canara Bank

- Union Bank of India

- Indian Bank

- Indian Overseas Bank

- Central Bank of India

- Allahabad Bank

- UCO Bank

How to Apply?

Depending on the lending institution, the registration process may differ slightly. The following is a general registration procedure for the scheme:

- Contact a bank or financial institution in your area that is implementing the Annapurna Scheme.

- Obtain the scheme's application form.

- Fill out the application form completely and attach any essential papers, such as ID proof and business registration documents.

- Submit the completed application form, along with the required documentation, to the bank or financial institution.

- The loan will be processed after the bank or financial institution verifies the application and paperwork.

- The cash will be transferred to the applicant's account upon loan approval.

The Annapurna Scheme is an incredible initiative aimed at empowering women and fostering their economic ambitions. This initiative provides essential assistance to women in converting their passion for cooking into profitable small-scale food catering businesses.

Conclusion:

In conclusion, the Annapurna Scheme stands out as a critical tool for achieving gender equality and economic development in India's food service sector. By providing financial assistance and encouraging female entrepreneurship, the scheme envisions a future in which women can turn their culinary talents into thriving small-scale food businesses, contributing not only to their own financial independence but also to the nation's overall economic growth.

Through a streamlined loan application process in collaboration with various banks and financial institutions, the Annapurna Scheme seeks to strengthen women's self-employment opportunities and promote inclusive entrepreneurship. It is a commendable initiative that not only paves the way for financial self-sufficiency but also empowers women to be at the forefront of culinary entrepreneurship, leaving an indelible mark on the economic landscape of the country.

In addition to the transformative impact of the Annapurna Scheme, initiatives like "Acehours" play an essential role in supporting aspiring entrepreneurs and small businesses in India. "Acehours" as an MSME-focused consulting platform, provides invaluable guidance and resources to individuals and businesses seeking to navigate the complexities of entrepreneurship. Through personalized consultations, expert insights, and tailored strategies, Acehours empowers entrepreneurs, both women and men, to make informed decisions, enhance their business acumen, and thrive in the competitive market. With a holistic approach to entrepreneurship, Acehours contributes to the broader vision of economic growth and prosperity, complementing the Annapurna Scheme's efforts to foster inclusive development in India's entrepreneurial landscape.