Empowering Women Entrepreneurs: The Nari Shakti Scheme for MSMEs

Launched by the Indian government as part of its broader agenda to enhance the economic empowerment of women, the Nari Shakti Scheme aims to provide robust support to women-owned and managed Micro, Small, and Medium Enterprises (MSMEs). This initiative reflects a significant commitment to fostering gender equality in the business sector and harnessing the untapped potential of women entrepreneurs.

Initiated by the Ministry of Micro, Small & Medium Enterprises, the Nari Shakti Scheme was introduced to specifically address the challenges faced by women in accessing finance for business development. The government, along with various financial institutions, actively promotes this scheme through multiple channels including social media, workshops, and partnership with women-centric organizations to ensure wide reach and accessibility.

Impact and Benefits

Since its inception, the Nari Shakti Scheme has been instrumental in aiding countless women entrepreneurs to start, sustain, and scale their businesses. By providing targeted financial products and services, the scheme has not only contributed to the economic empowerment of women but also promoted inclusive growth and diversity in the entrepreneurial ecosystem.

Scheme Guidelines

Here’s a detailed look at the scheme’s guidelines and offerings:

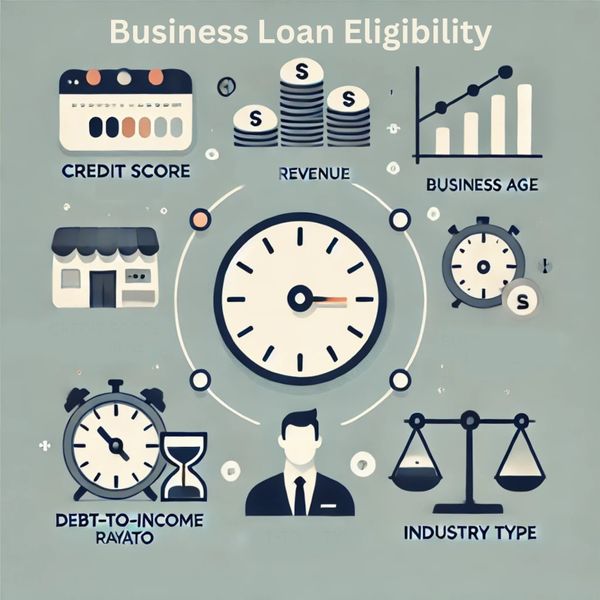

Eligibility Criteria

The Nari Shakti Scheme is exclusive to women entrepreneurs. To qualify, the enterprises must be either:

- Women-owned and managed MSMEs: Businesses where women hold a minimum of 51% of the share capital.

- Self-Help Groups (SHGs): These must have valid Udyam Registration, a government recognition for MSMEs that simplifies regulatory processes.

This focus ensures that the benefits of the scheme directly support women in the business sector, fostering greater economic inclusivity.

Purpose

The scheme offers two primary financial facilities:

- Term Loan: This can be used for the purchase or construction of business premises, renovation, or for buying plant and machinery. Such financial support is crucial for the expansion and modernization of businesses.

- Cash Credit (CC) for Working Capital: To help manage the day-to-day expenses of running a business, the scheme provides a revolving credit facility. This is essential for maintaining liquidity and ensuring smooth operational flow without financial hiccups.

Quantum of Finance

The financial assistance under the scheme varies based on the nature of the enterprise:

- Minimum Loan Amount: Rs 2.00 lakh

- Maximum Loan Amount: Up to Rs 10.00 crore for MSMEs and Rs 20 lakh for SHGs.

These figures are designed to cover a wide range of business needs, from small startups to well-established enterprises looking to scale up.

Margin Requirements

The scheme is structured with varying margin requirements, which reduces the initial financial burden on entrepreneurs:

- Up to Rs 1.00 crore: 5% margin

- Above Rs 1.00 crore: 15% margin

This tiered approach makes it easier for newer or smaller enterprises to gain access to necessary funds.

Charges

To further ease the financial load, the scheme offers:

- No processing charges for loans up to Rs 2.00 crore.

- 50% concession on processing charges for loans above Rs 2.00 crore.

Additional charges adhere to the existing guidelines of the bank, ensuring transparency and fairness.

Collateral and Security

Understanding the challenges women entrepreneurs face in securing loans, the scheme provides:

- No collateral for loans up to Rs 2.00 crore, under the coverage of Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

- Hybrid model of CGTMSE coverage and collateral: For loans above Rs 2.00 crore, only 25% of the portion uncovered by CGTMSE needs to be secured with collateral.

This approach significantly lowers the barriers to entry for securing financial support.

Conclusion

The Nari Shakti Scheme is a pivotal step towards fostering a supportive ecosystem for women entrepreneurs. By addressing key financial barriers and providing tailored financial products, the scheme not only empowers women to lead and expand their businesses but also contributes to the broader goal of economic diversity and resilience. Women entrepreneurs looking to leverage such opportunities should consider the Nari Shakti Scheme as a viable option to bolster their business ventures and drive long-term growth.

At Acehours, we're committed to empowering women entrepreneurs like you through the Nari Shakti Scheme. Whether you're starting a new venture or looking to expand your existing business, our dedicated team is here to guide you every step of the way. From navigating the application process to optimizing your business plans, we ensure you have all the resources to leverage this transformative opportunity.

Unlock your business potential with Acehours—where women's business dreams turn into reality.

Download Now to access our comprehensive guide on the Nari Shakti Scheme and begin your journey to business success!