Digital Escrow a Boon for MSME's.

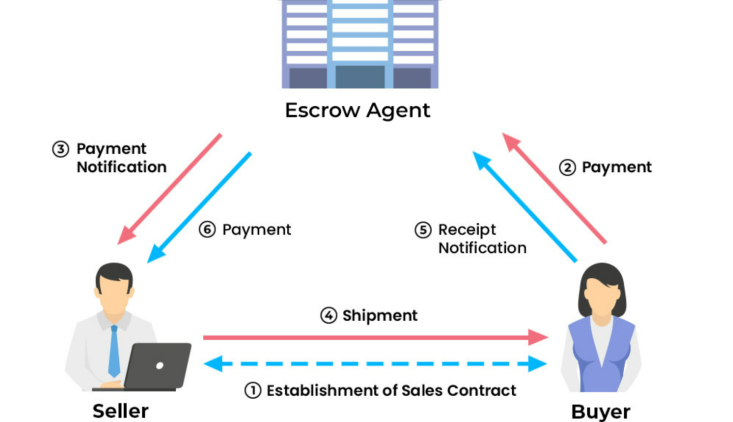

Introduction: A digital escrow mechanism is a secure and trusted online arrangement used to facilitate transactions between two parties (Buyer and Seller), especially in situations where there might be concerns about trust or risk. It ensures that both parties fulfill their respective obligations before the transaction is completed and the funds or assets are released.

Here's how a digital escrow mechanism generally works:

- Agreement: The parties involved in the transaction (usually a buyer and a seller) agree on the terms of the transaction. This includes details such as the price, delivery conditions, quality of the goods or services, and any other relevant terms.

- Escrow Agent: An escrow agent is a trusted third party that manages the escrow account. This could be a specialized online platform, a financial institution, or even a legal firm. The agent ensures that the terms of the agreement are met before releasing the funds or assets to the appropriate party.

- Funds or Assets Deposit: The buyer deposits the agreed-upon funds or assets into the escrow account. This shows their commitment to the transaction and their willingness to fulfill their part of the agreement.

- Verification: The seller then proceeds to fulfill their part of the agreement, such as delivering the goods or providing the services as agreed. This could involve providing proof of delivery, confirming the quality of the items, or meeting any other specified conditions.

- Inspection and Approval: The buyer inspects the delivered goods or services to ensure they meet the agreed-upon conditions. If everything is satisfactory, the buyer approves the release of funds or assets from the escrow account.

- Release of Funds or Assets: Once both parties have fulfilled their obligations and any necessary approvals have been obtained, the escrow agent releases the funds or assets from the escrow account. These funds/assets are then transferred to the seller.

- Completion: The transaction is now complete. Both parties have received what they expected, and the escrow mechanism has helped ensure a secure and fair exchange.

Benefits for MSME's :

Digital escrow can provide several significant benefits to small business owners, helping them navigate transactions more confidently and securely. Here's how digital escrow mechanisms can be advantageous for small business owners:

- Trust Building: Small businesses might not have established reputations or long-standing relationships with their customers. Using a digital escrow mechanism can help build trust with new clients by assuring them that their payments will only be released once the goods or services have been delivered as agreed.

- Reduced Risk: Small businesses often operate on tight budgets and can't afford the risk of non-payment or fraudulent transactions. Digital escrow minimizes the risk of not being paid for products or services rendered, giving small business owners more confidence to engage in transactions.

- Protection from Fraud: Scams and fraudulent activities are prevalent online. Digital escrow systems can act as a barrier against fraudulent buyers or sellers, ensuring that only legitimate transactions proceed.

- Access to Wider Markets: Small businesses can expand their customer base by engaging in transactions with clients from different locations. Digital escrow enables cross-border transactions by providing a secure platform for international trade.

- Easier Dispute Resolution: In case of disagreements or disputes between the business owner and the customer, the escrow agent can help mediate and make a fair decision based on the terms of the transaction. This reduces the likelihood of lengthy legal battles.

- Smooth B2B Transactions: Small businesses often engage in transactions with other businesses (B2B). Digital escrow can facilitate these transactions, ensuring that both parties uphold their end of the agreement before the funds are released.

- Professionalism: Using a digital escrow service adds a layer of professionalism to transactions. It shows that the business is serious about its commitments and values its customers' trust.

- Cash Flow Management: For service-based businesses, receiving payments upfront and holding them in escrow until the service is provided can help with cash flow management. This ensures that the business has the necessary funds to deliver on its promises.

- Cost-Effective: Small businesses might not have the resources to implement their own escrow solutions. Utilizing a digital escrow platform is often more cost-effective than setting up and managing an in-house system.

- Simplifies Legalities: Transactions can involve complex legalities and contracts. A digital escrow mechanism can help streamline this process by ensuring that contractual terms are met before funds are released, reducing the need for legal interventions.

- Time Savings: Small business owners often wear multiple hats, and managing transactions can be time-consuming. A digital escrow service handles the transaction process, saving time and allowing business owners to focus on core operations.

Cost of Digital Escrow:

The cost of using a digital escrow service can vary depending on the platform or provider you choose, the complexity of the transaction, and the specific terms of the agreement. Generally, digital escrow services are designed to be accessible to a wide range of businesses, including small and medium-sized enterprises (SMEs). However, there are some factors to consider when evaluating the potential costs:

- Transaction Fees: Many digital escrow providers charge a fee based on the value of the transaction. This fee can vary and might be a percentage of the transaction amount. For smaller transactions, the fee might be relatively low, while larger transactions could incur higher fees.

- Subscription Plans: Some digital escrow platforms offer subscription plans that provide businesses with access to their services for a regular fee. Depending on the volume of transactions you anticipate, a subscription plan might offer cost savings compared to paying individual transaction fees.

- Additional Services: Some providers might offer additional services, such as dispute resolution assistance or customization options, which could come with extra charges.

- Cross-Border Transactions: If you're conducting cross-border transactions, there could be additional fees associated with currency conversion, international bank transfers, and compliance with different regulatory requirements.

- Complex Transactions: Transactions with multiple milestones, specific delivery conditions, or customized terms might require additional administrative work, which could lead to higher costs.

- Value vs. Risk: While digital escrow services come with costs, they also provide value by reducing risks associated with fraud, non-payment, or disputes. The potential benefits of using an escrow service can often outweigh the costs, especially for businesses that want to build trust with customers and partners.

In summary, digital escrow mechanisms offer small business owners a secure and efficient way to conduct transactions, reduce risks, and build trust with their customers.

By providing a level playing field in the digital marketplace, these mechanisms can help small businesses compete effectively and expand their operations.

we at 'Acehours' are launching digital escrow on Acehours platform, powered by our digital escrow partner. The Plans are attractive and cost effective for any MSME to use.