Success Recipe: NSIC's Bank Credit Facilitation Decoded

Micro, Small, and Medium Enterprises (MSMEs) play a crucial role in the economy. However, there has been a persistent challenge in finding suitable financing options to support their growth. Some of these firms frequently fail because of a lack of adequate and timely finance.

The Central Government has introduced several initiatives and measures to financially support these MSMEs. The Credit Facilitation Scheme has been developed by the National Small Industries Corporation (NSIC).

Here's a more in-depth look into NSIC.

What is the NSIC Credit Facilitation Scheme?

To assist MSMEs financially, the NSIC has inked an Agreement of Understanding with a number of private and public sector banks. Through these institutions, NSIC assists MSMEs in obtaining finance. The Bank Credit Facilitation Scheme (BCFS) is a cooperative venture that assists such enterprises in obtaining necessary capital from both public and private sector banks.

What Characteristics Characterize the NSIC Credit Facilitation Scheme?

The following are some important aspects of the NSIC Credit Facilitation Scheme that should be emphasized:

- Credit is made available to MSMEs through collaboration with public and private sector banks.

- It assists MSMEs in completing the required documentation and submitting it to the bank.

- It offers MSMEs the flexibility to switch their accounts to another bank or to apply for a new banking relationship.

- A credit request sponsored by NSIC is given particular consideration under the Credit Facilitation Scheme, which allows MSMEs to secure bank financing based on their lending policies.

- It provides MSMEs with hands-on assistance.

- It makes it simpler for many MSMEs to get financing when applying for credit.

What Types of Loans Are Offered Under the Credit Facilitation Scheme?

Under the NSIC Credit Facilitation Scheme, MSMEs can obtain the following types of loans:

Term Loan

These loans provide business owners with the funds they require to build the necessary facilities and purchase assets and equipment. Term loans normally have a loan term of 1 to 10 years, although this time can be extended to 30 years based on the loan amount and interest rate. Term loans are classified into three types: short-term, medium-term, and long-term.

Loan for Working Capital

Working capital limits function as rotating cash credit facilities under the BCFS. Owners of businesses may withdraw working capital up to the limit on credit set by the financial institution. Cash credit, overdrafts on book debts, discounting facilities, and other services are available to business owners.

Non-fund Limitation

Using the BCFS credit facility, business owners can seek financial assistance from a financial institution such as a bank or NBFC. The service comprises establishing a credit account with the bank, from which the company's owner can withdraw funds up to a predetermined limit to fund various business activities.

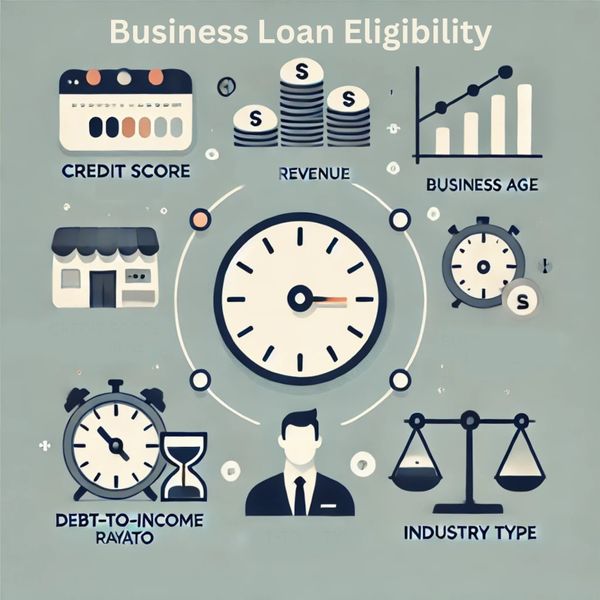

What Are the Credit Facilitation Scheme Eligibility Criteria?

All Indian MSMEs are eligible to apply for the Credit Facilitation Scheme. You simply need to ensure that your company has been registered with the appropriate authorities and acknowledged by the Indian government.

What Documents Are Required to Apply for the NSIC Credit Facilitation Scheme?

In order to qualify for a Bank Credit Facilitation Scheme, you must submit a comprehensive range of documentation. The list may differ based on the purpose of the loan. However, the following documents are required:

- Identity verification

- Address verification

- Details about the company's address

- If the business premises are rented or leased, rent a lease/permit.

- Asset and liability reports for guarantors, promoters, directors, and others, as well as the most recent IT return.

- Copies of the Entrepreneurs Memorandum and the SSI registration certificate

- Balance sheet for the last three years, including IT/ST returns.

- Profile of the business, detailing promoters' names and addresses, type of activity, experience, shareholding distribution & so on.

- Application in the prescribed format

- Projected balance sheets for the next two years.

- Account status with present bankers

- If the loan amount exceeds 100 lakh, CMA data in the approved format is required.

- Project reports are required for term loans.

- Estimates/Quotations/Approved Building Plan

- Pollution Control Board approval

- Letter of sanction from the electricity authorities

- Trust Deed/Memorandum and Articles of Association/Rules and Bylaws

- Monthly manufacturing and sales figures for the current fiscal year, finished items, stock in process value, debtors and creditors, and so on.

How can I Apply for a Loan Under the Credit Facilitation Scheme?

The submission process is straightforward. Simply follow the instructions:

Step 1: Visit the official NSIC website: NSIC : National Small Industries Corporation .

Step 2: Save and print the application form.

Step 3: Thoroughly fill up the form with all of the relevant company and personal information.

Step 4: Deliver the application form, along with all supporting documentation, to the appointed official.

You must approach an officer of a bank that has a contract with NSIC or has been authorized under the credit facilitation system. In addition, you must open a current account with the bank and provide KYC documentation. Throughout the process, the branch officer will assist you.

Conclusion:

The NSIC Loan Facilitation Scheme has been instrumental in helping many MSMEs secure the loans they need. It is one of the government's best initiatives to assist and grow indigenous businesses.

FAQs:

1.What is the credit facilitation scheme's general payback period?

The repayment period for the Credit Facilitation Scheme is typically 5 to 7 years. However, in rare exceptional circumstances, this limit can be extended to 11 years.

2.How much credit assistance am I eligible for under this program?

You will receive credit assistance based on your needs. Banks, on the other hand, have fixed-term loan restrictions. If you require credit support for up to 5 crores for working capital, the amount you need should be 25% of the estimated following year's turnover. A working capital loan demand of more than 5 crore is assessed using the highest Permissible Bank Finance Method.

3. Is there a charge for applying to the NSIC Credit Facilitation Scheme?

No, there is no processing charge for applying to the NSIC Credit Facilitation Scheme.

4. Is there any collateral or security required to obtain a loan through the NSIC Credit Facilitation Scheme?

The criteria for providing any collateral or security in order to obtain a loan through the NSIC Credit Facilitation Scheme differs from bank to bank. Before applying, you must verify with the bank.